On 21 July 2020, the Government announced JobKeeper 2.0 to have effect from 29 September 2020 to 28 March 2021. This article considers some of the key modifications announced.

Since its announcement on 30 March 2020, the JobKeeper Payment (‘JKP’) scheme has been a lifeline for businesses and not-for-profit entities alike, with many across various industries pushing for the Government to extend the scheme beyond its end date of 27 September 2020.

On 21 July 2020, the Government confirmed that it is extending the scheme from 28 September 2020 until 28 March 2021, albeit with various modifications that tighten the eligibility requirements and reduce the payment rate. In relation to existing arrangements for JKP until 27 September 2020, the Government confirmed that no changes are to be made.

Whilst detailed guidance has yet to be released on the measures, this article provides a summary of the key modifications based on what has been announced to date.

Restricting eligibility

Under the current version of the JKP scheme, one of the key eligibility requirements is that the business or not-for-profit entity must satisfy the decline in turnover test.

The basic decline in turnover test operates by comparing the entity’s projected GST turnover for its turnover test period (the month or quarter in 2020 being tested) with its current GST turnover for the relevant comparison period (i.e. the corresponding period in 2019). In addition, the ATO has prescribed a number of alternative decline in turnover tests for certain classes of entities where the normal comparison period is not appropriate. The entity is only required to satisfy the decline in turnover test (either the basic test or one of the alternative tests) once – i.e. it does not need to retest in subsequent months/quarters.

Under the new rules, an entity will need to meet a modified decline in turnover test showing they have had an ongoing decline in actual (not projected) turnover in order to be eligible for JKPs post 27 September 2020.

Specifically, in order for an entity to be eligible for JKP between 28 September 2020 to 3 January 2021, they must demonstrate that their actual GST turnover has fallen by the required percentage (i.e. 15% for ACNC-registered charities, 30% for other entities with aggregated turnover of less than $1 billion, and 50% for other entities with aggregated turnover of more than $1 billion) in each of the June and September 2020 quarters relative to comparable quarters in 2019.

Further, for an entity to be eligible for JKP between 4 January 2021 and 28 March 2021, the entity will again need to demonstrate the required fall in actual GST turnover in each of the June, September and December 2020 quarters relative to comparable periods.

Importantly, this means that if an entity did not have the requisite decline in turnover in either of the June or September 2020 quarters, they will not be eligible to receive JKPs after 27 September 2020. If the entity only fails to meet the test in the December 2020 quarter, the JKPs will only cease after 3 January 2021.

The ATO will have the discretion to set out alternative tests in circumstances where comparing actual turnover in a 2020 quarter with actual turnover in the corresponding 2019 quarter is inappropriate.

It is worth noting that the Treasury factsheet on the proposed modifications states that entities will generally be able to assess their eligibility based on details reported in Business Activity Statements – this is somewhat different to the current JKP rules where entities are technically required to calculate ‘GST turnover’, although this is subject to various administrative proxies permitted to be used by the ATO. It will be interesting to see how Treasury reconciles this approach with the current JKP rules.

Reduction in payment rate

Currently, the payment rate under the JKP scheme is $1,500. This is both the minimum amount employers must pay their employees (at least $1,500 before tax per fortnight) as well as the amount the employer will receive from the ATO. This is regardless of the hours worked by the employee during that time.

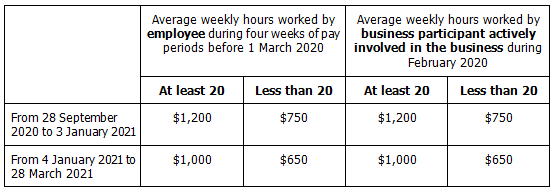

From 28 September 2020, the modifications introduce both a reduced payment rate and a two-tiered payment rate system based on average weekly work hours in February 2020.

Specifically, the payment rate will be as follows:

The ATO will have a discretion to set out alternative tests where the employee’s/business participant’s hours were not usual during the relevant period.

In relation to the two tiered system for employees, what is relevant is the number of hours worked in February – the type of employment contract applicable to the employee (i.e. full-time, part-time, casual) and the average weekly hours worked post 1 March 2020 both do not appear to be relevant in determining which of the two tiers applies.

However, the tiered system is still based on the underlying requirement that the individual is an eligible employee as defined in the existing rules (noting that this definition is not expected to change). For example, the higher payment rate may be payable in relation to a casual whose average weekly hours during the relevant period were at least 20 hours, but only if the casual was a long-term casual as at 1 March 2020 and met all the other relevant criteria.

Conclusion

There are still many questions regarding JobKeeper 2.0 which, unfortunately, will likely only be answered once we see the relevant legislation/legislative instruments. In the meantime, businesses and not-for-profit entities should consider how they may be affected by the proposed modifications.