Government announcement regarding easing financial reporting burdens for charities

In August 2018, an independent review of the Australian Charities and Not-for-profits Commission legislation was handed down and included 30 recommendations relating to objects, functions and powers; regulatory framework; red tape reduction; and additional amendments (click here to see review findings). The Government’s response to these recommendations was released in March 2020, with the Government agreeing to some, but not all of the recommendations.

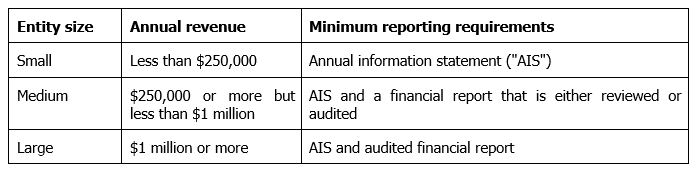

One of the recommendations related to the financial reporting threshold for charities. Currently, the reporting requirements for charities are as follows:

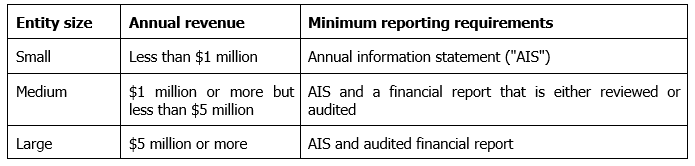

The recommendation proposed that these thresholds be lifted as follows:

On 15 December 2020, the Treasurer announced that this recommendation would move forward with the Council on Federal Financial Relations (“CFFR”) agreeing to develop a framework by mid-2021, with the expectation that:

Over 3,000 charities will no longer need to produce reviewed financial statements, saving each charity around $2,400 in accounting expenses annually. In addition, approximately 2,000 charities will no longer be required to produce audited financial statements saving around $3,000 annually.

Very little information regarding the framework was provided in the announcement and it remains to be seen whether the CFFR will lift the thresholds in line with the above proposal.

In addition to the above, the Treasurer also announced that the CFFR had also agreed to establish a cross-border recognition model to provide a single registration point for national operators to reduce the cost for charitable fundraisers operating across multiple jurisdictions. Again, very little information has been provided and charities will need to watch this space to find out more.

This article provides a general summary of the subject covered as at the date it is published. It cannot be relied upon in relation to any specific instance. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use. It is not intended to be, nor should it be relied upon as, a substitute for professional advice.