No ABN Withholding

We recently received a question from a member asking whether there was a requirement to withhold from a payment being made to an overseas supplier, as that supplier did not have an ABN.

The question was being asked as the supplier had included as part of their terms and conditions the following clause (referred to as a ‘gross-up clause’):

You will make all payments without tax deduction unless as is required by law in which case the payment due from you will be increased so that the balance payable will be the amount if no tax deduction had been made.

Two issues emerge:

- How do these gross-up clauses work? and

- Is there a withholding requirement?

Gross-Up Clauses

These gross-up clauses are relatively common where entities provide services across international borders, and are used to ensure a supplier receives in cash the amount invoiced without any reduction due to withholding taxes.

Example 1:

- Assume the amount being paid to the overseas supplier is $100.

- Assume the withholding tax rate is 15%.

- The payer is required to withhold $15 and pay this to the ATO.

- In the absence of the gross-up clause, the overseas supplier would only receive $85.

- The intended effect of the gross-up clause is that the amount payable to the overseas supplier is $100.

- Therefore, the amount is grossed-up (in this case, to $117.64) so that after the 15% is withheld and paid to the ATO ($17.64, being 15% of $117.64), the overseas supplier receives $100.

- The gross-up formula is $X / (1 – withholding rate). In the above example = $100/0.85.

The current no ABN withholding rate is 47% (the top marginal rate). Therefore, if the no ABN withholding rules apply, and there is a gross-up clause, cost to the payer will substantially increase.

Example 2

- Assume the amount being paid to the overseas supplier is $100.

- Assume the withholding tax rate is 47%.

- The payer is required to withhold $47 and pay this to the ATO.

- In the absence of the gross-up clause, the overseas supplier would only receive $53.

- The intended effect of the gross-up clause is that the amount payable to the overseas supplier is $100.

- Therefore, the amount is grossed-up (in this case, to $188.68) so that after the 47% is withheld and paid to the ATO ($88.68, being 47% of $188.68), the overseas supplier receives $100.

No ABN withholding?

The no-ABN withholding rules (and exemptions from withholding), are dealt with under s.12-190 of Schedule 1 to the Taxation Administration Act 1953.

Subsection 12-190(1) states:

(1) An entity (the payer) must withhold an amount from a payment it makes to another entity if:

(a) the payment is for a supply that the other entity has made, or proposes to make, to the payer in the course or furtherance of an enterprise carried on in Australia by the other entity; and

(b) none of the exceptions applies.

Therefore, if the supplier is an overseas supplier, and they do not make the supply in the course or furtherance of an enterprise carried on in Australia, condition (a) would not be met and the payer does not need to withhold under this provision.

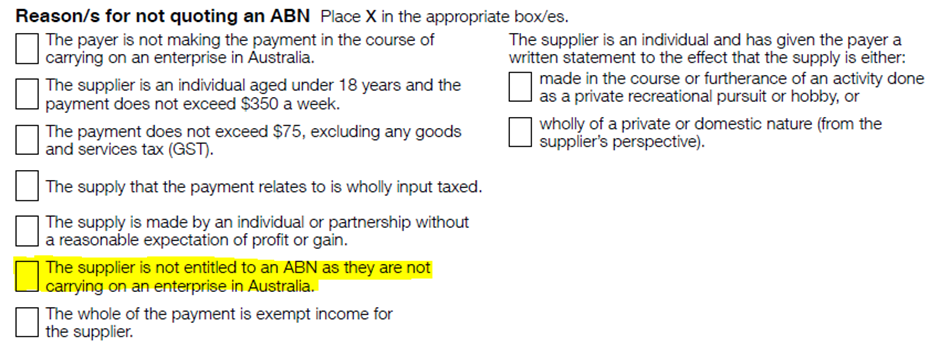

It may not be obvious to the payer at the time of the transaction whether the overseas supplier is carrying on an enterprise in Australia or not. In such cases, the payer may need to confirm this with the overseas supplier. Alternatively, the payer could ask the overseas supplier to complete the ‘Statement by supplier’ declaration (see the extract below with the relevant box as highlighted – noting the other boxes refer to the various exemptions that can apply).

See the ATO website page which includes a link to the current Statement by Supplier here.

However, before the overseas supplier can complete and sign the declaration, it may need to clarify whether it is treated as carrying on an enterprise in Australia.

Carrying on an enterprise in Australia?

With the ABN and GST legislation both introduced at the same time, the terminology used in both laws was initially the same. However, the GST law was changed to refer to ‘the ‘indirect tax zone’ while the ABN law continues to refer to ‘Australia’. In this regard, we note subsection 12-190(7), which states:

(7) In working out, for the purposes of this section, whether an enterprise is carried on in Australia, ignore any part of Australia that is not in the indirect tax zone (within the meaning of the GST Act).

Note: The effect of this subsection is to treat an enterprise as carried on in Australia only where it would be treated as carried on in the indirect tax zone under the A New Tax System (Australian Business Number) Act 1999.

Other than the above provision, the ABN law does not provide any further reference or definition of when an entity is carrying on an enterprise in Australia (or the indirect tax zone). The GST law, however, sets out at section 9-27 when an enterprise of an entity is ‘carried on in the indirect tax zone’, namely:

- if the enterprise is carried on by one or more individuals through a fixed place in the indirect tax zone; or

- if the enterprise is carried on by one or more individuals through one or more places in the indirect tax zone for more than 183 days in a 12 month period; or

- if the enterprise is carried on by one or more individuals and the entity intends to carry on the enterprise through one or more places in the indirect tax zone for more than 183 days in a 12 month period.

Notes:

The individuals referred to are:

- if the entity is an individual – that individual;

- an employee or officer of the entity;

- an individual who is, or is employed by, an agent of the entity that (i) has, and habitually exercises, authority to conclude contracts on behalf of the entity, and (ii) is not an independent broker or agent acting in the ordinary course of their business.

It also doesn’t matter whether the entity has exclusive use of a place, or owns, leases or has any other claim or interest in relation to a place.

Broadly, if the overseas supplier does not have any employee or officers in Australia, it is unlikely the overseas supplier will be carrying on an enterprise in Australia.

For more guidance refer to MT 2006/1 the ATO’s public ruling on whether an entity is carrying on an enterprise for ABN purposes, and GSTD 2006/6 where the ATO confirms that MT 2006/1 has equal application to the meaning of ‘entity’ and ‘enterprise’ for the purposes of the GST law.

Need more guidance on this topic or have any other questions? Please ask us via the Q&A portal.

Need more guidance on this topic or have any other questions? Please ask us via the Q&A portal.

If you would like to become a member, please contact us at admin@taxed.com.au.

Subscribe to our newsletter for more updates and articles.

This article provides a general summary of the subject covered as at the date it is published. It cannot be relied upon in relation to any specific instance. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use. It is not intended to be, nor should it be relied upon as, a substitute for professional advice.