JobMaker hiring credit: What is it & how does it work?

What are the proposed details of the JobMaker Scheme? Can your organisation utilize the Scheme? Is a particular prospective employee within the ambit of the Scheme?

The JobMaker Hiring Credit scheme that was announced as part of the 2020-21 Federal Budget (‘Scheme’) is designed to improve the prospect of young individuals getting employment in Australia and increase workforce participation by providing financial incentives to encourage employers to hire additional workers. From an organisation’s point of view it is an employment subsidy.

At the time of writing, the enabling legislation has been enacted and the rules governing the Scheme have been published as an exposure draft that was released on 30 October 2020. They are set out in a draft legislative instrument, Coronavirus Economic Response Package (Payment and Benefits) Amendment Rules (No. 9) 2020, and are described in draft explanatory material that accompanied the instrument.

It is expected that the draft Rules will be finalised very shortly, given that entities seeking to participate in Scheme from its outset must give notice by 6 January 2021.

The nub of the Scheme

The Scheme commences on 7 October 2020 and ends on 6 October 2022.

Eligible employers who can demonstrate that the employment of new eligible employee(s) increases their overall headcount and payroll will receive $200 per week for eligible employee aged 16 to 29 years (at time of employment commencement), or $100 per week for eligible employee aged 30 to 35 years (at time of employment commencement). The JobMaker Hiring Credit payment will be available for the first 12 months from the date of employment of the eligible employee, with a maximum amount of $10,400 per additional new position created. Rather than calculating and summing a subsidy for each employee, the Rules envisage an aggregated quantification approach that is broadly described under ‘Amount of payment’ later in this article.

The Scheme will be administered by the ATO. The ATO has stated that they will, in due course, provide further information regarding how employers can register for the Scheme and information on eligibility criteria etc. when it becomes available.

The Scheme has a variety of constraints aimed at preventing artificially increasing the number of employees who attract the subsidy, including preventing the reduction in the level of work of older employees to allow employment of subsidised employees.

We expect readers will be primarily interested in whether their organisation is an eligible employer and, if so, who is an eligible employee. However, to understand these concepts and to appreciate the ability to utilize the Scheme, brief reference is initially made to the concept of JobMaker periods and to the two conditions relating to such utilization. The two conditions are also reflected in the ceilings of the ‘headcount amount’ and the ‘payroll amount’ that define the quantum of a subsidy payment.

JobMaker Periods

The JobMaker Hiring credit payment will be calculated on a quarterly basis and paid in arrears. There are eight JobMaker periods for which eligible employers can lodge claims for eligible employees – these being:

- 7 October 2020 to 6 January 2021 (JP1);

- 7 January 2021 to 6 April 2021 (JP2);

- 7 April 2021 to 6 July 2021 (JP3);

- 7 July 2021 to 6 October 2021 (JP4);

- 7 October 2021 to 6 January 2022 (JP5);

- 7 January 2022 to 6 April 2022 (JP6);

- 7 April 2022 to 6 July 2022 (JP7); and

- 7 July 2022 to 6 October 2022 (JP8).

However, in order to qualify for a credit payment for an eligible employee in a JobMaker period, an eligible employer must satisfy the following ‘additive’ criteria:

- there must be an increase in the eligible employer’s overall employee headcount in the JobMaker period for which the claim is sought as compared to a baseline headcount amount, and

- there must be an increase in employer’s payroll in the JobMaker period for which the claim is sought as compared to a baseline payroll amount.

Increase in headcount condition

As noted above, in order to access the payment under the Scheme in relation to a JobMaker period, the employee headcount for the relevant period must exceed the baseline headcount for that period.

An employer’s overall headcount for a JobMaker period is determined at the end of the relevant period.

The baseline headcount amount for the first four JobMaker periods (i.e. JP1 to JP4 as outlined above) is the greater of one and the number of employees that the eligible employer had as at 30 September 2020.

For the fifth and subsequent JobMaker periods (i.e., JP5 to JP8 as outlined above), the baseline headcount amount will be adjusted up to ensure that only additional employment receives the credit payment and only for 12 months after employment.

Determining whether there has been an increase in overall employee headcount for the fifth and subsequent JobMaker periods can be complicated and a detailed analysis is beyond the scope of this article. We refer you to Examples 2.1 and 2.2 of the explanatory materials.

For present purposes, it suffices to paraphrase the introductory statement in the explanatory materials – the baseline headcount amount for the fifth and the subsequent JobMaker periods is generally worked out as the greater of the baseline headcount increase amount for the corresponding JobMaker period 12 months prior, or the increase of the previous period. The process of calculating the headcount increase amount for the corresponding period takes into account that additional employees engaged in the corresponding period may not have been employed for the full duration of the period.

Payroll increase condition

An eligible employer satisfies the payroll increase condition for a JobMaker period if the sum of its payroll amounts (for all employees) for each pay cycle that ended in the relevant JobMaker period exceeds its baseline payroll amount for the period.

An eligible employer’s baseline payroll amount is the sum of its payroll amounts (for all employees) for such number of consecutive pay cycles (ending on or before 6 October 2020) as is equal to the number of pay cycles that ended in the relevant JobMaker period. In other words, when comparing the total payroll amount for a JobMaker period and the baseline payroll amount of a reference period, the number of pay cycles that ended within the JobMaker period (e.g. weekly, fortnightly or monthly as the case may be) will determine the number of equivalent pay cycles used in comparison to the reference period.

Examples 3.1and 3.2 in the explanatory materials illustrate the condition The materials also identify the nature of the payments that are relevantly treated as payroll amounts.

Eligibility criteria for employers

An employer will be eligible to receive the credit payment where the employer:

- notifies the ATO in the approved form of its election to participate in the Scheme before a claim is made;

- meets the above ‘additive’ headcount and payroll conditions;

- is claiming in respect of an eligible employee(s);

- has kept sufficient records to substantiate its claims;

- carries on a business in Australia (or be a non-profit that pursues its objectives principally in Australia, or be a certain deductible gift recipient);

- has an Australian Business Number and is registered for Pay-As-You-Go Withholding;

- is reporting through single touch payroll;

- is up to date with its taxation lodgement obligations (including business activity statements) that become due in the two years before the time it nominates to participate in the Scheme; and

- is not entitled to receive a JobKeeper payment in respect of an individual for a JobKeeper fortnight that begins during the JobMaker period.

Ineligible employers

Certain employers are specifically excluded from the Scheme. The excluded employers are (i) those in liquidation or who have entered into bankruptcy; (ii) the Commonwealth, a State, a Territory, or an authority of any of these; (iii) a local governing body: (iv) entities wholly owned by entities listed in items (ii) or (iii); (v) those subject to Major Bank Levy; and (vi) sovereign entities (e.g. body politic of foreign countries or foreign government agencies). However, according to the draft explanatory material, Australian universities may participate in the scheme.

Eligibility criteria for employees

To be an eligible employee, the individual must:

- commence employment between 7 October 2020 and 6 October 2021 and not more than 12 months before the start of the relevant JobMaker period;

- be aged between 16 and 35 years inclusive at the time they commenced employment;

- have worked (which includes paid leave and paid public holidays) an average of 20 hours a week for each whole week the individual is employed by the eligible employer during the relevant JobMaker period.;

- have received parenting payment, JobSeeker payment or Youth Allowance (except if the individual was receiving such payment on the basis that they were undertaking full time study or was a new apprentice) for at least 4 out of 12 weeks immediately before commencement of employment with the eligible employer (‘pre-employment condition’);

- have given written notice to the eligible employer in an approved form confirming that they satisfy the age requirement (i.e. aged between 16 and 35 inclusive), meet the above pre-employment condition and that they have not given a similar notice to another entity that they wish to participate in the Scheme. (Note: This notification ceases to have effect once the individual ceases employment.)

Ineligible employees

Certain individuals are specifically excluded from the Scheme. Such individuals include:

- employees for whom the employer is also receiving wage subsidy under another Commonwealth program:

- employees in respect of whom another employer is claiming the JobMaker Hiring Credit payment;

- an individual who was engaged any time within the 6 months between 6 April 2020 and 6 October 2020 by the entity that is seeking the JobMaker payment as a contractor or subcontractor where they worked in a substantially similar role or performed substantially similar functions or duties.

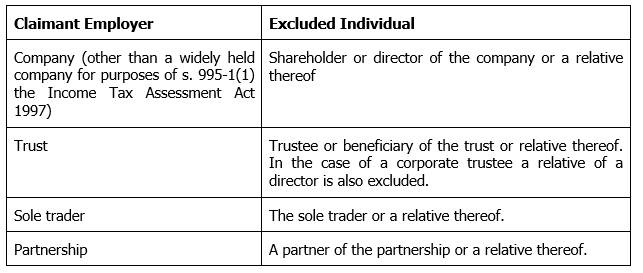

Where the claimant employer is any of the following, the specified individuals are also excluded from the Scheme:

Amount of payment

The amount of an eligible employer’s JobMaker hiring credit payment for a JobMaker period is the lesser of the eligible employer’s ‘headcount amount’ and their ‘payroll amount’ for the relevant period. It is expected that the ATO will establish systems to automate these two calculations for most employers.

The explanatory material comments:

‘The headcount amount is worked out on a daily basis for the JobMaker period and has been designed to ensure that the … [Scheme] recognises periods of partial employment during the period to optimise the maximum amount payable to an employer without requiring the employer to track and claim for the most efficient combination of eligible employees with their headcount for the period’.

It also notes:

‘The payroll amount is the excess of the total payroll amount for a JobMaker period compared to the reference period payroll amount worked out according to the payroll increase condition’.

The two concepts are illustrated in the explanatory materials at Examples 4 and 5 respectively.

Northern Territory JobMaker Booster

It is worth noting that as part of the Northern Territory Government 2020-21 Budget, the NT government will also provide a wage subsidy to supplement the Scheme. Relevant Territory businesses will be entitled to receive up to a period of 12 months:

- in relation to eligible employees (as defined for the purposes of the Territory Scheme) aged from 30 to 35 $100 per week, and

- in relation to eligible employees (as defined for the purposes of the Territory Scheme) aged over 35 years – $200 per week. The conditions regarding eligibility are set out in the Northern Territory Government JobMaker Booster factsheet.

Conclusion

The JobMaker requirement for being an ‘eligible employer’ will prevent a significant part of the NFP sector from utilising the Scheme, with notably local government being ineligible. Also notably (and understandably) limiting utilisation of the Scheme, an organisation in receipt of JobKeeper payments is, apart from minor overlap, simultaneously unable to access the JobMaker payments

For those entities that are eligible, care will especially need to be taken to ensure the prospective employee meets the pre-employment condition as well as the other employee eligibility requirements.

As a practical matter, if your organisation potentially qualifies for the Scheme, it is important to consider the adequacy of its existing processes and procedures that enable it to monitor, record and maintain appropriate and adequate records to substantiate its JobMaker Hiring Credit payments claims.

As a final remark, we observe the proposed deadline for accessing the first JobMaker period payment is 6 January 2021. Organisations will need to monitor the finalisation of the Rules and the institution of processes to access JobMaker payments in view of this relatively imminent deadline.

This article provides a general summary of the subject covered as at the date it is published. It cannot be relied upon in relation to any specific instance. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use. It is not intended to be, nor should it be relied upon as, a substitute for professional advice.