GST – How to determine if something is regulatory in nature

When looking at the characterisation of exempt taxes, fees and charges, the GST provisions refer to supplies being regulatory in nature. How do you determine whether the provision of information, or thing being done, is regulatory in nature?

When trying to determine whether a tax, fee or charge will be exempt from GST under Division 81 of the GST Law, one of the questions entities will need to answer is whether the thing being supplied is regulatory in nature. This will be a key question where the supply is the provision of information.

The object of this article is to provide a background to the operation of Division 81 of the GST law, as well as tools to assist in the determination of whether a supply is regulatory in nature or not.

Introduction

By way of background, Division 81 and the GST Regulations provide the rules of determining the GST classification and treatment of taxes, fees and charges. In particular, Division 81 provides that GST does not apply to certain taxes, fees and charges by treating such payments as not being the provision of consideration for GST purposes. Further, the GST Regulations prescribe certain taxes, fees and charges to also be excluded from GST, or confirm that they are subject to GST.

Whilst in concept this should be fairly simple, at times, working through these provisions can be a little confusing.

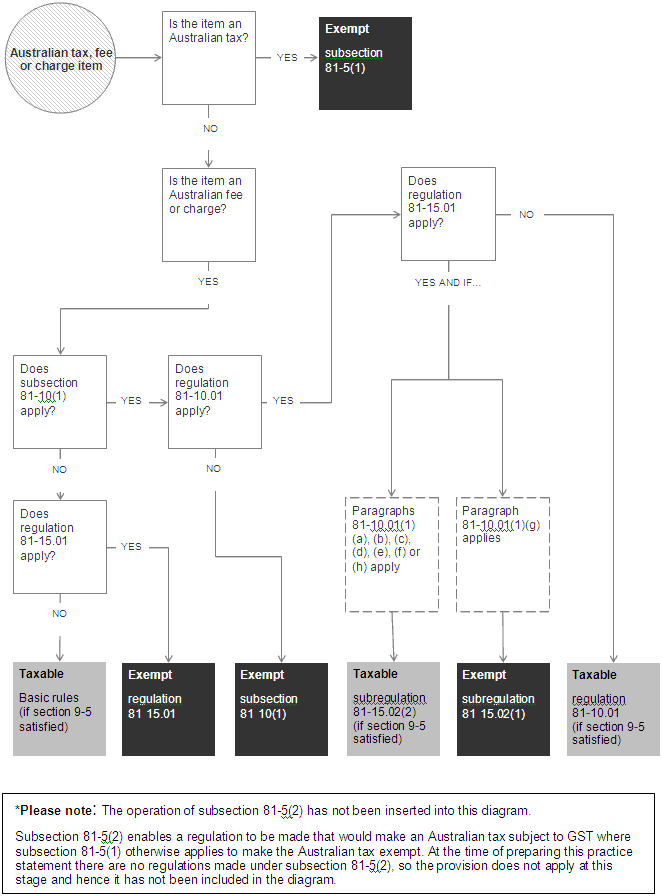

A helpful publication to assist entities with navigating the provisions is the ATO’s Practice Statement PS LA 2013/2 (GA), titled ‘GST treatment of Australian fees or charges under Division 81 of the A New Tax System (Goods and Services Tax) Act 1999‘. Effective as at 1 July 2013, this Practice Statement sets out the ATO’s administrative approach to determine the GST classification of taxes, fees and charges. One of the tools included in the Practice Statement is a flowchart designed to assist entities navigate through the relevant provisions and Regulations to determine the GST classification of a payment.

For ease of reference, we have included the flowchart below.

The GST Regulations

It is noted that when working through this flowchart, an entity will also need to refer back to the actual provisions and GST Regulations.

For the purposes of this article, we note that the GST Regulations treat:

- ‘a fee or charge for the supply of a regulatory nature made by an Australian government agency’ [at GST Reg 81-15.01(1)(f)] as not being subject to GST; and

- ‘a fee or charge for the provision of information by an Australian government agency if the provision is of a non-regulatory nature’ [refer GST Reg 81-10.01(1)(f)] and ‘a fee or charge for a supply of a non-regulatory nature’ [refer GST Reg 81-10.01(1)(g)] as both being subject to GST.

In the flowchart, the above Regulations are referred to in the boxes with the dashed outlines – one resulting in a ‘taxable’ classification, the other resulting in an ‘exempt’ classification.

How do you determine if something is regulatory in nature (or not)?

To assist in determining what constitutes matters that are of a regulatory nature, guidance can be found in the Explanatory Statement to the amending GST regulations, as well as comments in ATO public rulings.

Paragraphs 4.26 to 4.36 of the Explanatory Statement, particularly paragraphs 4.26 to 4.28, provide guidance on what was intended by Parliament to be exempt and what was intended to be taxable. Again, for convenience we have included an extract below (with emphasis in bold):

‘4.26 These amendments ensure that a payment or the discharging of a liability to make such a payment, for certain categories of Australian fees or charges will not be treated as the provision of consideration and therefore, any supply to which the payment relates will not be subject to GST. A supply to which a payment, or the discharging of a liability to make such a payment, relates will not be subject to GST to the extent the payment is for a fee or charge covered by subsection 81-10(1) of the GST Act. For a supply to which a fee or charge relates not to be subject to GST, the fee or charge must be imposed under an Australian law and be payable to an Australian government agency. [Schedule 4, item 2, subsection 81-10(1)]

4.27 To the extent a payment, or the discharging of a liability to make such a payment, is a payment or discharge of an Australian fee or charge that relates to, or relates to the application for, the provision, amendment or retention under an Australian law, of a permission, exemption, authority or licence, it will not be treated as the provision of consideration. Therefore, any supply to which the fee or charge relates will not be subject to GST. A fee or charge in relation to the provision, amendment or retention of a permission, exemption, authority or licence (however described) includes but is not limited to:

-

-

- application fees, licences, permits and certifications that are required by government prior to undertaking an occupation (for example, medical and legal professionals’ right of practice licences, pilots’ licences, heavy vehicle drivers’ licences and adjustments to such licences); and

- regulatory charges imposed to undertake an activity (for example, compulsory testing fees for regulatory purposes, compulsory inspection fees for regulatory purposes, a permit for restaurants to occupy the footpath, and a licence for an event to close roads).

-

4.28 As noted, this exemption applies to an Australian fee or charge imposed in relation to, or to the application for, the retention of a permission, exemption, authority or licence. An example of such a fee would be a periodic compulsory inspection fee, made under an Australian law and payable to an Australian government agency, for the retention of a permit. In such cases, the inspection fee is directly related to the retention of the permission (the permit) and would not be subject to GST. In cases where the inspection fee is payable to a private entity (not an Australian government agency) then subsection 81-10(4) of the GST Act will not apply and the supply will be taxable provided it meets the requirements of section 9-5 of the GST Act. [Schedule 4, item 2, subsection 81-10(4)]’

Essentially (and unless specifically stated otherwise) any fee that is charged under an Australian Law is regulatory in nature, and intended to be exempt.

Further guidance can be found in public rulings, for example Class Rulings CR 2013/1 and CR 2013/41. (We note that these class rulings have been issued, and apply, to a specified class of entities, namely members of the Local Government Association of New South Wales (NSW) and the Shires Association of NSW. However, the comments do provide guidance on the ATO view and can be useful to other councils or shires that are not members.)

In this regard, Class Ruling CR 2013/1 provides the following comments (emphasis in bold):

’38. Regulation 81-15.01 sets out those fees and charges that are prescribed for section 81-15 and which do not constitute consideration. In particular subregulation 81-15.01(1)(f) refers to ‘a fee or charge for a supply of a regulatory nature made by an Australian government agency’.

39 The term ‘regulatory nature’ is not defined in the GST Regulations or the GST Act. The explanatory statement to the A New Tax System (Goods and Services Tax) Amendment Regulation 2012 (No. 2) states:

-

-

- The term ‘regulatory’ captures those supplies made by a government agency, where that agency is legislatively empowered to make the relevant supply and the supply is to satisfy a regulatory purpose.

- In some instances, although the consumer acquires something that may be of intrinsic value to the consumer, the acquisition is made in the context of satisfying a regulatory requirement of an Australian law…

-

-

- Regulation 81-10.01 sets out Australian fees and charges that are prescribed fees and charges treated as consideration for subsection 81-10(2).’

Class Ruling CR 2013/41 provides the following comments in the context of something being ‘non-regulatory’ (emphasis in bold):

’35. Regulation 81-10.01 of the GST Regulations sets out those fees and charges that do not fall within the principles contained in the Intergovernmental Agreement, and therefore supplies to which they relate are not intended to be exempt from GST. These fees or charges include a fee for the non-regulatory provision of information and a payment for a commercial sale of books by a government bookshop. These fees or charges are treated as consideration for a taxable supply if the other conditions of section 9-5 are met.

-

- Regulation 81-10.01 of the GST Regulations also ensures that the regulatory activities of government made in competition with the private sector are subject to GST where the other requirements of section 9-5 are satisfied.

- The ES explains that the regulations ensure that the regulatory activities of government made in competition with the private sector are subject to GST where the other requirements of section 9-5 are satisfied. It states:

-

- Fees and charges in this category are not excluded from being consideration for a taxable supply. This is consistent with the National Competition and Consumer Policy guidelines and ensures that a government entity is not given a competitive advantage over a private sector supplier making the same type of supply.

- This covers situations in which government agencies have authorised private agencies to perform activities that form part of a regulatory process, for example, certification activities which are required for a regulatory process to be followed. Where government agencies, as well as government certifiers, have authorised private certifiers to perform certification activities these fees and charges will continue to be consideration for a supply that is subject to GST. This ensures competitive neutrality between supplies made by government and non-government agencies.

- This paragraph applies only where a government agency is providing a supply in a competitive market, or where private suppliers have been accredited or authorised to make a supply over which the agency would otherwise have a monopoly.

- This paragraph does not cover supplies of information that are regulatory in nature and can only be supplied by government agencies, notwithstanding that the public may obtain such information through a private sector supplier acting as a conduit for the information from the government agency. The supply is only a taxable supply where the private sector entity charges for the supply in its own right.’

Conclusion

Based on the above, a payment of a fee or charge will be for an item that is regulatory in nature where the amount is imposed under an Australian law and payable to an Australian government agency. Put another way:

- the payment is for supplies made by a government agency, where that agency is legislatively empowered to make the relevant supply; and

- the supply is to satisfy a regulatory purpose, or the acquisition is made in the context of satisfying a regulatory requirement of an Australian law.

This should be kept in mind when applying a process to classify GST treatment of fees and charges, such as using the ATO’s flowchart.

However, note the exclusion where supplies of a regulatory nature are made in competition with the private sector.

This article provides a general summary of the subject covered and cannot be relied upon in relation to any specific instance. It is not intended to be, nor should it be relied upon as, a substitute for professional advice. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use.

This article provides a general summary of the subject covered as at the date it is published. It cannot be relied upon in relation to any specific instance. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use. It is not intended to be, nor should it be relied upon as, a substitute for professional advice.