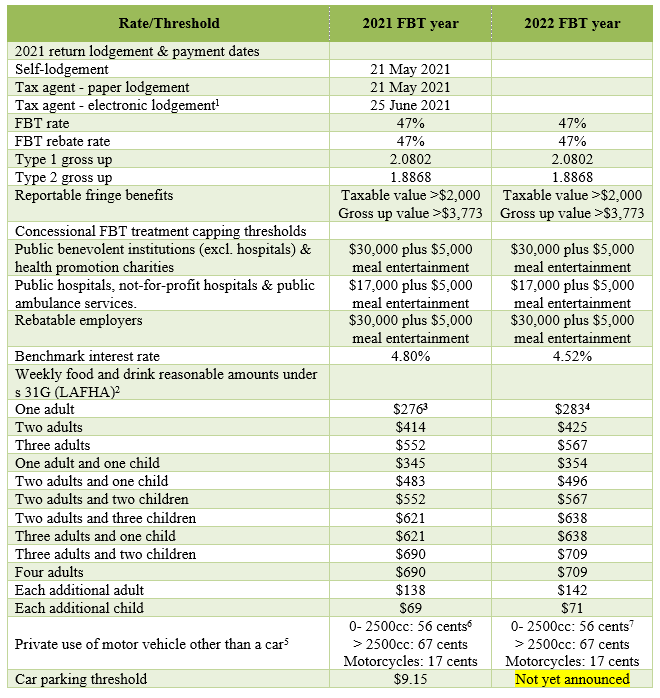

Below we have compiled a quick reference guide of the key FBT rates and thresholds for 2021/22 including a comparison to 2020/21. We have also included lodgement dates for the FBT 2021 return. These rates and thresholds are available on the ATO website.

- ¹To be eligible for the 25 June 2021 lodgement date, a tax agent must appoint themselves as acting on your behalf by for the FBT role on their ATO lodgement program by 21 May 2021.

- 2We note that for the purposes of these thresholds an adult is a person who has attained the age of 12 years before the start of the FBT year.

- 3See https://www.ato.gov.au/law/view/pdf/pbr/td2020-004.pdf

- 4See https://www.ato.gov.au/law/view/pdf/pbr/td2021-003.pdf

- 5We note that the use of the cents per km method of determining the taxable value of a motor vehicle other than a car is limited to circumstances where the where the business use of the vehicle is extensive (see MT 2034)

- 6See TD 2020/3

- 7See TD 2021/4