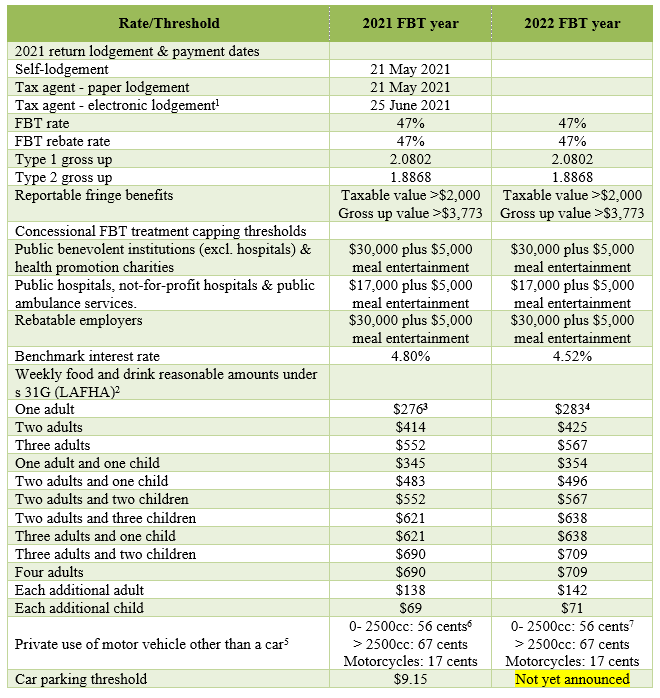

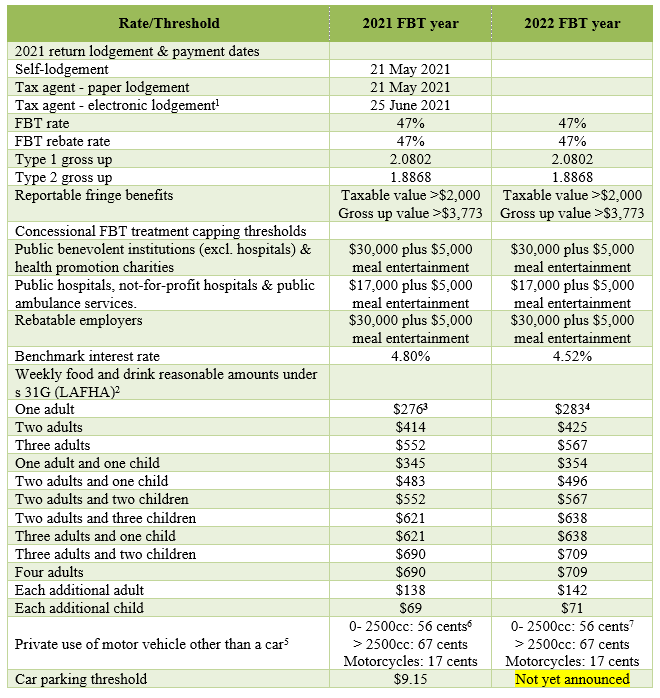

Below we have compiled a quick reference guide of the key FBT rates and thresholds for 2021/22 including a comparison to 2020/21. We have also included lodgement dates for the FBT 2021 return. These rates and thresholds are available on the ATO website.

- ¹To be eligible for the 25 June 2021 lodgement date, a tax agent must appoint themselves as acting on your behalf by for the FBT role on their ATO lodgement program by 21 May 2021.

- 2We note that for the purposes of these thresholds an adult is a person who has attained the age of 12 years before the start of the FBT year.

- 3See https://www.ato.gov.au/law/view/pdf/pbr/td2020-004.pdf

- 4See https://www.ato.gov.au/law/view/pdf/pbr/td2021-003.pdf

- 5We note that the use of the cents per km method of determining the taxable value of a motor vehicle other than a car is limited to circumstances where the where the business use of the vehicle is extensive (see MT 2034)

- 6See TD 2020/3

- 7See TD 2021/4

This article provides a general summary of the subject covered as at the date it is published. It cannot be relied upon in relation to any specific instance. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use. It is not intended to be, nor should it be relied upon as, a substitute for professional advice.