FBT and Payroll – Remote area tax concessions and payments

Heads up, there may be some changes to remote area tax concessions and payments. The Productivity Commission has suggested reforms.

The Productivity Commission has called for significant reforms to the tax concessions and payments to residents and businesses in remote Australia, so they are better targeted and fairer.

The Commission was asked to review three longstanding tax concessions and payments:

- the zone tax offset (ZTO);

- the remote area allowance (RAA); and

- the fringe benefits tax remote area concessions.

On 4 September 2019, the Commission issued a draft report, Remote Area Tax Concessions and Payments.

Public submissions in relation to the draft are due by Friday the 11th of October. The final report is expected to be handed to the Government in February 2020.

Some key points from the draft report

Zone Tax Offset

The Commission recommended the abolition of the ZTO, on the basis it was an ‘ineffective and blunt instrument’. The Commissioners note that some areas that remain eligible for the ZTO are no longer isolated.

The impact from the abolition of ZTO, based on the current annual base rates, are:

- a loss of $338 for those currently eligible for a Zone A tax offset,

- a loss of $57 for those currently eligible for a Zone B tax offset, and

- a loss of $1,773 for those currently eligible for a Special Zone Area tax offset.

The relevant loss increases if there are dependents.

Remote Area Allowance

The RAA is a supplementary payment for income support recipients in eligible areas and is a non-taxable payment. The Commission has found that the RAA is helping income support recipients meet some of the higher costs associated with living in remote areas.

The Commission recommends that areas eligible for RAA should be aligned with Australian Bureau of Statistics remoteness classification. The impact of realignment would mean that recipients in Darwin who are currently eligible for the RAA would no longer be eligible, while places such as Wilcannia, Longreach, the Yorke Peninsula and Tasmania’s Central Highlands that were previously excluded will now be brought into the RAA area.

The Commission has also recommended that the RAA payment rates be reset, ideally to take into account both inflation and to compensate for higher living costs in remote and very remote areas. Currently, the RAA rates are not indexed (unlike associated income support payments). Arguably, under this recommendation, recipients who currently qualify for a RAA and continue to qualify under the proposal may be in a better financial position.

Fringe Benefit Tax Remote Area Concessions

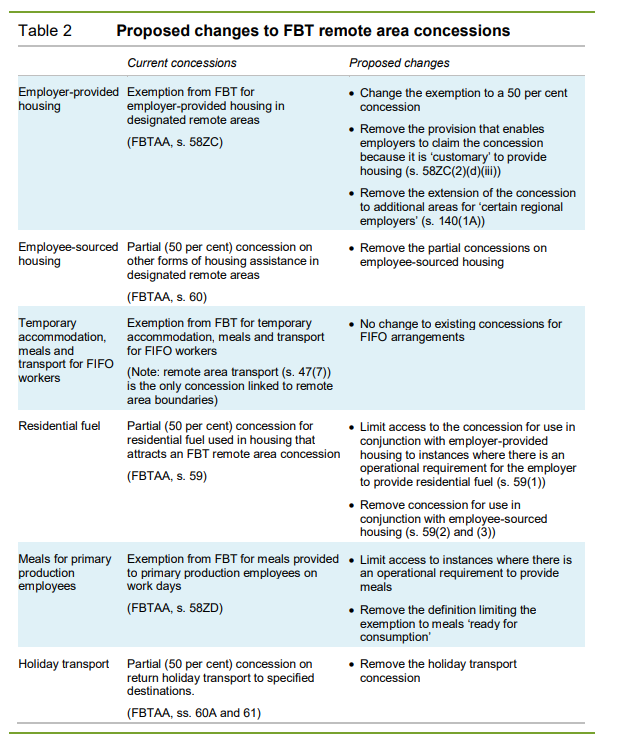

The Commission found that current fringe benefit tax remote area concessions are often not well targeted. The proposed changes are set out at Table 2 of the draft report and which is reproduced below.

It should be noted that the Commission is not proposing changes to the existing concessions for fly-in-fly-out arrangements. It is not clear whether the current boundaries that qualify for FBT remote area concessions will be retained or redefined. The draft report has asked for feedback on the merit of different options for redefining the boundaries for FBT remote area concessions.

Broad effects of changing the FBT remote area concessions

The broader impacts of the proposed changes to the FBT remote area concessions are:

- Changing the exemption for employer-provided housing to 50% is expected to substantially reduce the tax savings for employees currently living in remote areas that qualify for the concession.

- Employees/Employers may need to reassess their existing remuneration arrangements.

- Compliance costs are likely to increase.

- Employers may now be required to submit FBT returns which they could formerly have avoided when using, for example, the employer-provided housing concession.

- There will also be an increase in the level of documentation previously not required to be collected by employers from their employees (e.g. rental agreement, loan mortgage statements, electricity and bills etc as well as signed declaration forms).

We understand that many TaxEd members have staff who are located in remote areas of Australia and some of the proposed FBT changes will have a significant impact. We encourage members to refer to the draft report in detail. Adversely affected members should consider lodging a submission in relation to the draft report or might like to consider other advocacy action.

Further Information

The draft report and further details can be found at the following link:

https://www.pc.gov.au/inquiries/current/remote-tax/draft

This article provides a general summary of the subject covered as at the date it is published. It cannot be relied upon in relation to any specific instance. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use. It is not intended to be, nor should it be relied upon as, a substitute for professional advice.