Director Identification Numbers: Are your directors required to apply?

From November 2021, directors and alternate directors of certain organisations will need to apply for a director identification number (DIN).

The DIN is part of a package of reforms introduced to address illegal phoenix activity. The DIN will require all directors to confirm their identity and will be a unique identifier for each person who consents to being a director or alternate director. The person will keep their unique DIN even if they cease to be a director. It is not intended that a person’s DIN will be re-issued to someone else or that the person will have multiple DINs (except in limited circumstances).

Who will need a DIN?

Only directors and alternate directors of body corporates registered under the Corporations Act 2001 or the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act) are required to have a DIN. The legislation is drafted in such a manner as to provide flexibility for the DIN regime to be extended to other officer’s of a registered body if the officer is of a kind prescribed by the regulations. However, at this stage it only applies to directors and alternate directors of the following organisations:

- a private or publicly listed company;

- a company that is limited by guarantee;

- a corporate trustee;

- an Aboriginal and Torres Strait Islander corporation registered under the CATSI Act (i.e., ORIC registered companies);

- a registered foreign company;

- a registered Australian body that is a body corporate (for example an incorporated association with an Australian Registered Body Number (ABRN) which is registered under the Corporations Act).

Charities and not-for-profits (NFP) that are companies limited by guarantee under the Corporation Act are also included in this new regime.

Who does not need a DIN?

As the DIN is currently limited to those who are directors (or alternate directors) of body corporates, other officers such as a company secretary are not required to apply for a DIN.

Similarly, directors of an unincorporated association, cooperative etc are also excluded from the new regime.

Directors of incorporated associations (including those registered with the Australian Charities and Not-for-profits Commission) also are not required to obtain a DIN unless their incorporated association has a ABRN to operate outside the state or territory in which it is incorporated.

When to apply for DIN?

Application is only required once and can be undertaken online via the Australian Business Registry Services platform from November 2021.

A person who has consented to be a director can apply for a DIN prior to being appointed as a director.

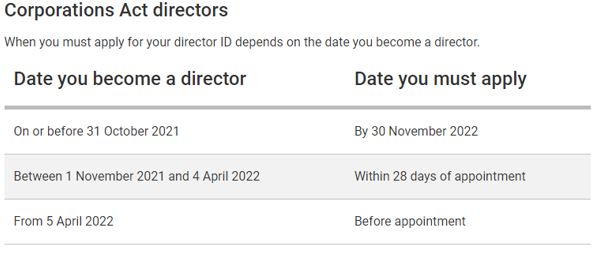

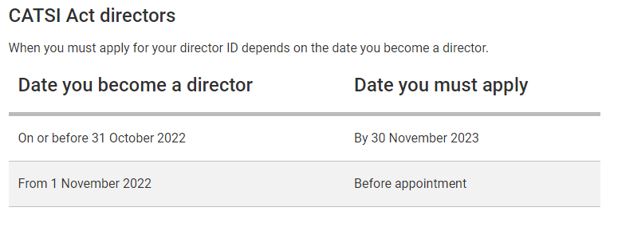

When a director must apply for a DIN will depend on whether they are Corporation Act or CATSI director as outlined below:

Source ABRS

The consequences of non-compliance

Civil and criminal penalties will apply if an eligible director or alternate director fails to apply within the above specified timeframe. The penalties also extend to deliberately providing false information to the registrar, intentionally providing a false DIN to a Commonwealth body or registered body corporate, or intentionally applying for multiple DINs.

What to do next?

All companies including ORIC registered companies should ensure that their directors (and alternate directors) are aware of this new regime, especially for any new directors who are appointed after 1 November 2021, as they need to apply for a DIN within 28 days of their appointment.

This article provides a general summary of the subject covered as at the date it is published. It cannot be relied upon in relation to any specific instance. TaxEd Pty Ltd and any person connected with its production disclaim any liability in connection with any use. It is not intended to be, nor should it be relied upon as, a substitute for professional advice.